This year the Bahamas Financial Services Board hosted its annual International Business and Finance Summit in conjunction with Bahamas Briefing on March 1st and March 2nd at the Baha Mar Convention Center. At the Bahamas Briefing international intermediaries got an opportunity to see and hear why the Bahamas is the jurisdiction of choice as local regulators and practitioners presented on the current state of the environment and why the Bahamas was the clear choice.

The following day IBFS was held and the event was a great success attracting over 170 registrants. Delegates heard from local speakers as well as international speakers from the United Kingdom, Canada, Miami and Singapore. This year’s theme entitled “Hitting the Reset Button” gave delegates insight into how the Bahamas can be proactive as we seek to reposition ourselves for sustainable growth and viability as a global financial center.

Opening the conference with the welcoming remarks was BFSB’s Chairman, Ms. Antoinette Russell, she stated that, “As we hit the reset button, practitioners and regulators alike must move away from describing our financial sector as offshore. The reality is that our business model is far better described as international. Therefore, we must remove offshore from our lexicon which is justified, in light of the preponderance of exchange of information agreements before and after CRS and the Bahamas’ commitment to these initiatives including BEPS. Once we acknowledge how far we have come then we can focus on the way forward.”

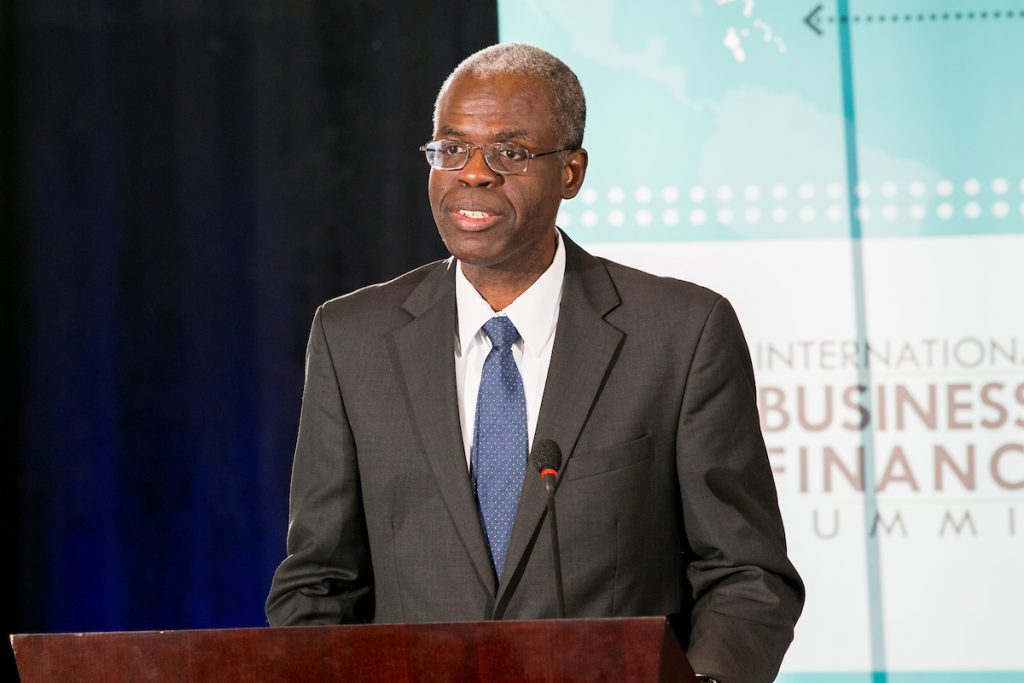

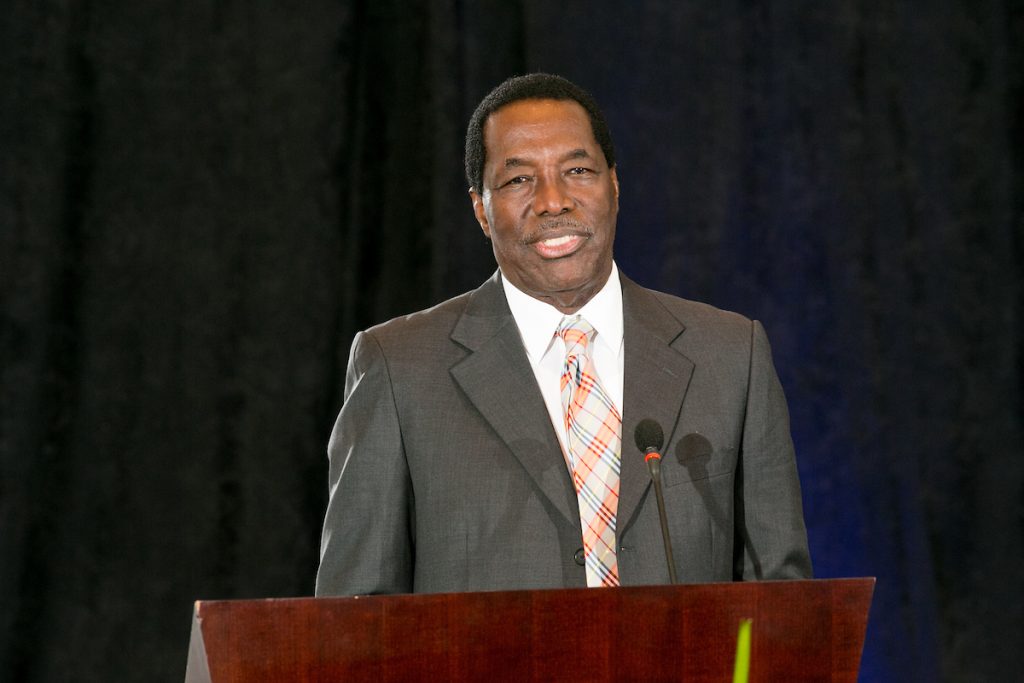

Hon. Brent Symonette, Minister of Financial Services Trade & Immigration brought opening remarks on the state of the industry. Governor John Rolle, Central Bank of the Bahamas spoke on the topic “Global Banking Issues and the Impact on Financial Services in The Bahamas”. He gave insight into international developments impacting the jurisdiction, the AML/CFT global environment and the Central Bank’s response. He also spoke to reshaping domestic policy and the importance of having an international voice.

Hon. Brent Symonette, Minister of Financial Services Trade & Immigration brought opening remarks on the state of the industry. Governor John Rolle, Central Bank of the Bahamas spoke on the topic “Global Banking Issues and the Impact on Financial Services in The Bahamas”. He gave insight into international developments impacting the jurisdiction, the AML/CFT global environment and the Central Bank’s response. He also spoke to reshaping domestic policy and the importance of having an international voice.

Sarah Venables of Deloitte UK spoke on the topic “Tax Strategies for the Bahamas as an IFC”. She shared insight into the current global environment, tax strategies of other IFCs, the potential impacts of corporate tax and policy considerations, and next steps for the Bahamas as a compliant jurisdiction.

The Hon. Philippe May of Arton Capital, Singapore spoke to the investor programs for residence and citizenship around the world under the theme “ Anatomy of the Global Citizen” while Susan Fulford of Dynamic Legacy Inc, Canada spoke about the Bahamian Offshore Trusts, Family Office Decisions and the Bahamas Advantage.

Mr. Don Stubbs of Scotia Wealth Management in Miami spoke to the role of the government, financial services providers and financial services professionals for the Bahamas to defend the wealth management sector and maintain its title as a reputable IFC.

The International Business and Finance Summit brought together key stakeholders, executives, local and international thought leaders together for a day of meaningful discussion on next steps in ensuring that the Bahamas remains a financial global contender and the international financial centre of choice.